India's Organized Retail Market in 2025 and Beyond: Market Size and Key Growth Drivers

India's retail sector is undergoing a remarkable transformation, moving steadily towards a more organized structure. This evolution, driven by urbanization, rising disposable incomes, and a growing preference for convenience, is set to redefine the retail landscape. Between CY2023 and CY2028, the sector is poised to grow at an impressive compound annual growth rate (CAGR) of 20%, with Tier-2 cities and beyond spearheading this change.

The Shift Towards Organized Retail

Traditionally dominated by unorganized retailers, India's retail market is now witnessing a shift towards organized formats, including brick-and-mortar stores and online platforms. These channels are not only capturing a fresh consumer base but are also converting traditional shoppers by offering superior services and operational efficiencies. The growth in Tier-2 cities, estimated at a staggering 32% CAGR over the next five years, highlights the untapped potential in smaller urban centers. However, the scope for growth isn't limited to these areas. Even Tier-1 cities, where unorganized retail still accounts for 50-55% of the market, present significant opportunities for organized players.

As this shift continues, India's retail market is expected to gradually align with the structures of more developed economies. For instance, organized retail currently accounts for 85-90% of the market in the United States and 50-60% in China, setting benchmarks for India to aspire towards.

Market Size of Organized Retail in India

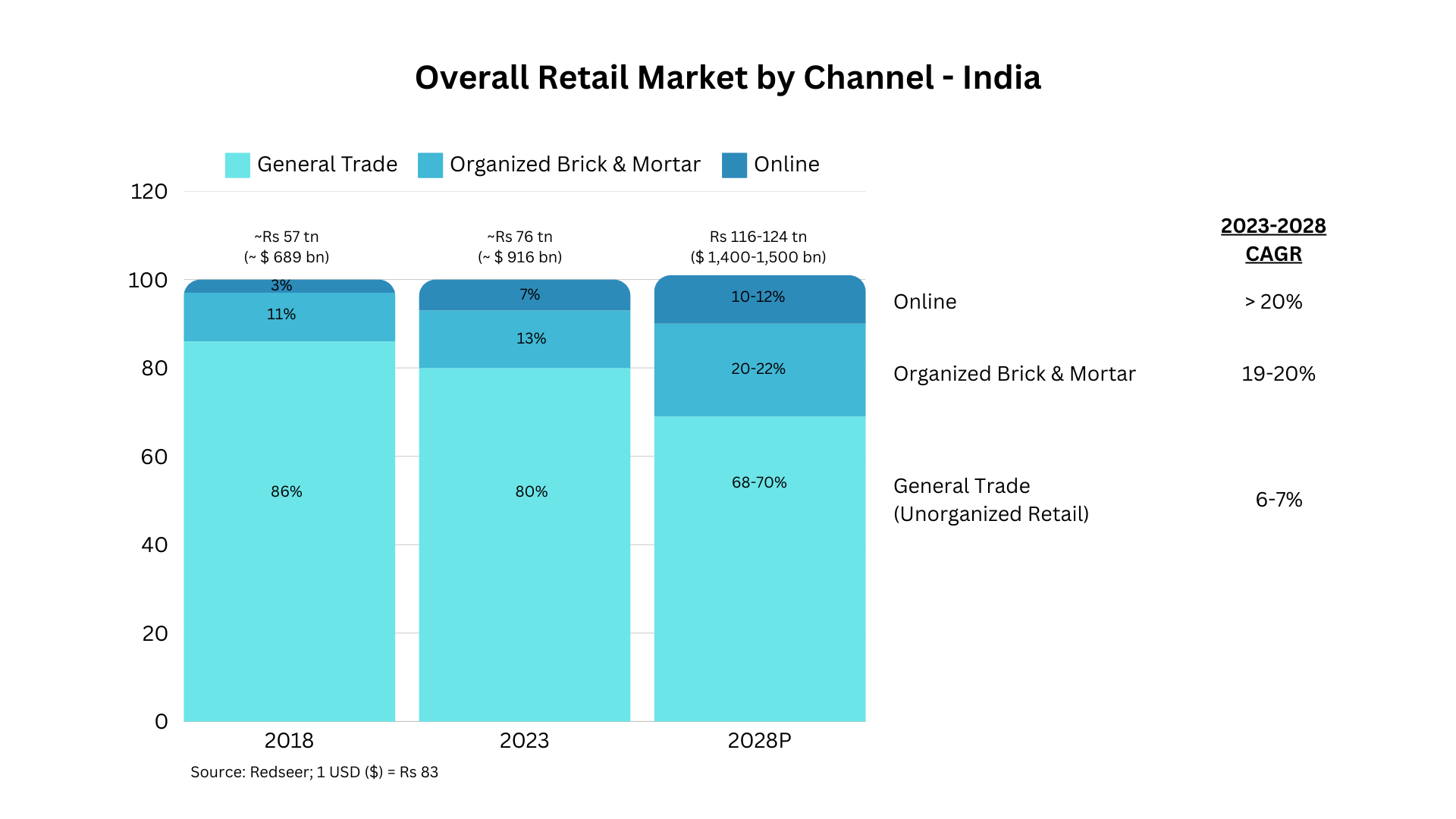

India's organized retail market has grown significantly over the past few years. From ₹7.7 trillion (approximately US$93 billion) in CY2018, it reached ₹14.9 trillion (approximately US$180 billion) in CY2023. By CY2028, it is projected to nearly triple, reaching ₹36-38 trillion (approximately US$434-458 billion).

Within this broader market, organized brick-and-mortar retail has also seen substantial growth. From ₹6.3 trillion (US$76 billion) in CY2018, it reached ₹10 trillion (US$120 billion) in CY2023 and is projected to grow to ₹23-26 trillion (US$277-313 billion) by CY2028, achieving a CAGR of 19-20%.

Source: Redseer; 1 USD ($) = ₹83.

Key Drivers of Growth in Organized Retail

Better Selection at Affordable Pricing

Organized retailers are redefining the shopping experience by offering a wide variety of high-quality products at competitive prices. By negotiating favorable terms with suppliers and investing in their supply chains, these retailers ensure better pricing and product quality for consumers. Transparent pricing practices build trust and foster loyalty, gradually steering shoppers away from unorganized markets.

Superior Consumer Experience

Modern organized retail is about more than just shopping - it's an experience. From optimized store layouts to ambient lighting and music, retailers are creating environments that influence purchasing behavior positively. In Tier-2 cities and smaller urban centers, the introduction of contemporary retail outlets is often met with enthusiasm, transforming shopping into a celebratory event. Additionally, the integration of technology into retail, such as targeted marketing and efficient inventory management, is further enhancing consumer satisfaction.

Agility and Market Insights

Unlike their unorganized counterparts, organized retailers possess the agility to adapt quickly to market trends and consumer preferences. Leveraging advanced technologies, they can identify emerging trends and introduce relevant products across their networks. This ability to stay ahead of consumer demands not only strengthens their market presence but also ensures higher satisfaction levels.

Investments in Retail Infrastructure

Infrastructure investments are a cornerstone of the shift to organized retail. Retailers are not only upgrading their existing stores to enhance the shopping experience but also expanding aggressively into new territories, particularly Tier-2 cities and beyond. This geographic expansion is enabling organized players to tap into new consumer bases, ensuring sustained growth.

The E-Commerce Revolution

The post-Covid era has seen a significant acceleration in the adoption of e-commerce. As of CY2023, India boasts 800-830 million internet users, a number expected to rise to over a billion by CY2028. Similarly, smartphone adoption is projected to grow from 670-680 million users in CY2023 to nearly 1 billion by CY2028. The digital boom, coupled with the growing influence of social media and digital advertising, is fueling e-commerce growth.

Future Outlook

India's retail sector is on the cusp of a significant transformation. As organized retail continues to grow, it will reshape consumer behavior and redefine the shopping experience. With the combined forces of technology, infrastructure development, and evolving consumer preferences, the market is set to become a key driver of economic growth. For businesses and consumers alike, the journey towards a more organized retail landscape promises to be both exciting and rewarding.