Quick Commerce in India 2025 and beyond

What is Quick Commerce?

The supply chain disruptions caused by the COVID-19 pandemic accelerated the emergence of Quick Commerce (Q-commerce), a unique business model that delivers essential goods, groceries, and other daily-use items within 10-30 minutes of ordering.

Quick Commerce focuses on hyper-local, technology-driven delivery services, specializing in the rapid fulfillment of online orders. By leveraging a network of strategically located dark stores, advanced inventory management systems, and optimized last-mile delivery networks, Q-commerce ensures ultra-fast delivery and enhanced customer convenience. This model represents a significant evolution, catering to the growing consumer demand for speed and accessibility.

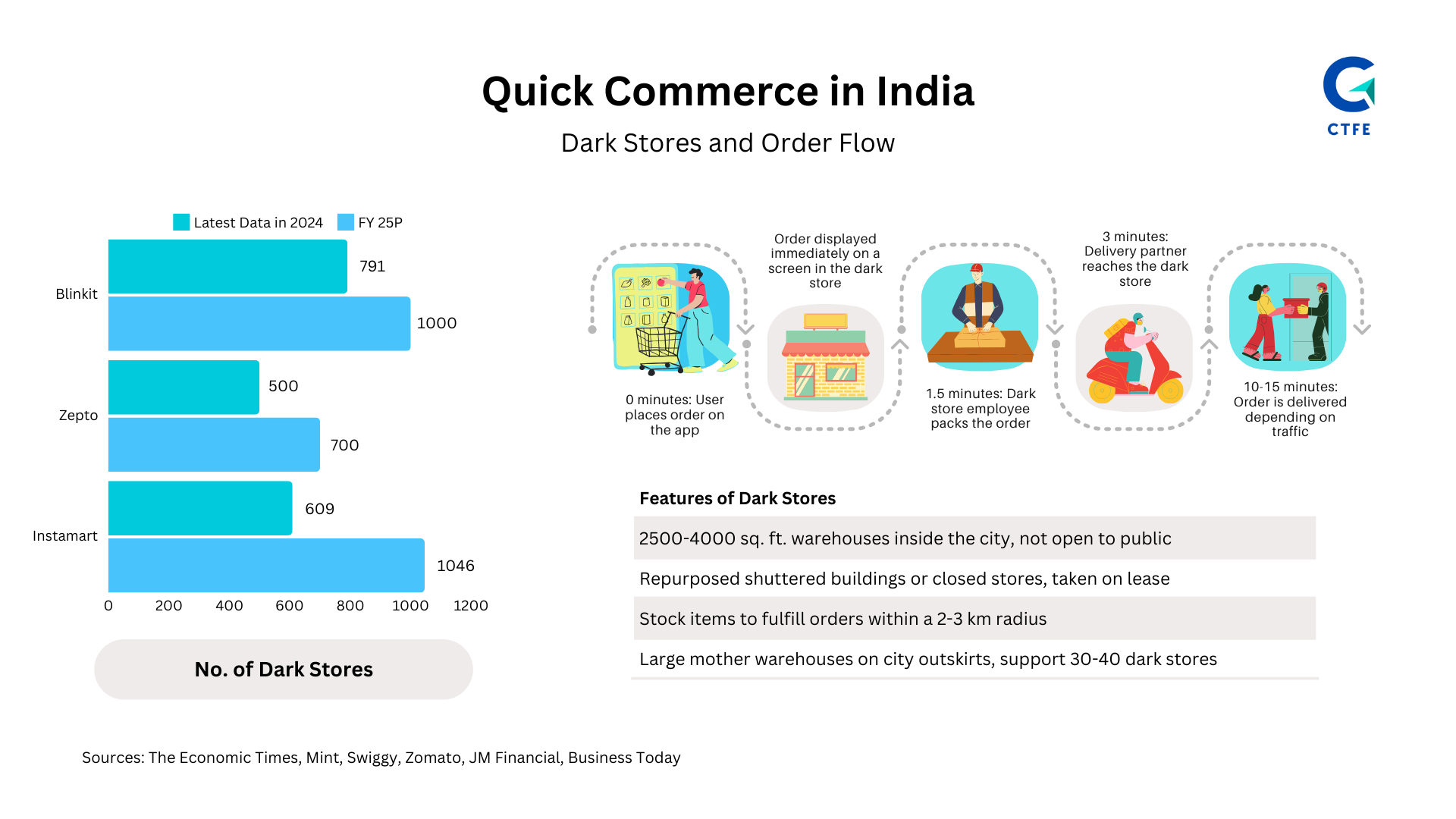

Dark Stores: The Foundation of Quick Commerce

At the heart of the Quick Commerce business model are dark stores. Dark stores are 2500-4000 sq. ft. warehouses located within the city, designed to fulfill online orders without being open to the public. These stores are often repurposed from shuttered buildings or closed stores, which are leased for this purpose. They stock essential items to meet customer demands within a 2-3 km radius, optimizing delivery times. Large mother warehouses located on the outskirts of cities support 30-40 dark stores, enhancing operational efficiency and coverage [Source: JM Financial].

In a quick commerce business, the order flow is streamlined. Customers place an order via the mobile app or website, selecting items from the available inventory. The system confirms the order, processes payment, and notifies the customer with an estimated delivery time. The order is routed to a nearby dark store or warehouse, where the fulfillment team picks and packs the items, typically within 1.5 minutes of order placement. Meanwhile, in a few minutes, the delivery partner reaches the dark store. Once packed, the order is handed over to a delivery agent. The delivery agent follows the most efficient route to deliver the order to the customer, typically within 10-15 minutes, fulfilling the order.

Q-commerce vs e-commerce

Unlike traditional e-commerce, which prioritizes extensive product ranges and scheduled deliveries (typically, taking more than a day), Q-commerce emphasizes speed, convenience, and immediate availability, catering primarily to urban consumers who value time efficiency and on-demand accessibility. By leveraging AI-driven logistics and real-time data, Q-commerce platforms offer a curated selection of high-demand items, ensuring rapid fulfillment and customer satisfaction.

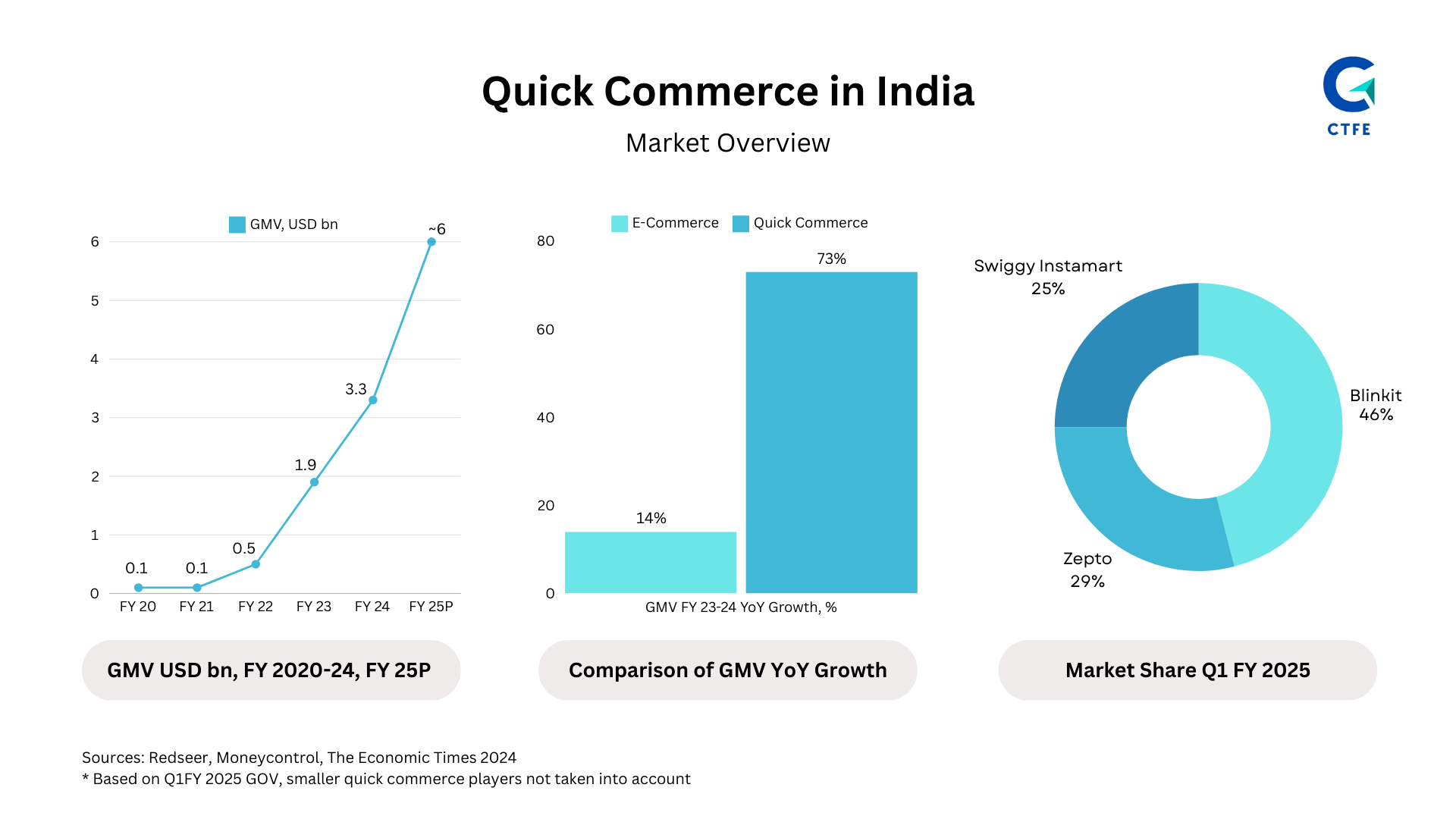

Market Size of Quick Commerce Industry in India

The Gross Merchandise Value (GMV) of quick commerce in India increased from $0.5 billion in FY 2022 to a staggering $3.3 billion in FY 2024. While India's e-commerce sector registered an annual growth rate of 14%, quick commerce has expanded at an impressive 73% annual growth rate during FY 2023-24, which is ~5x of e-commerce growth. This highlights the significant shift in consumer behavior towards faster and more convenient delivery options. Despite this growth, the current penetration rate stands at just 7% of the total addressable market, which is valued at $45 billion, indicating significant untapped potential [Source: The Economic Times, JM Financial, Redseer].

Top Quick Commerce Companies in India

With more than 10 active players, the space was very competitive till a couple of years back. However, contrary to expectations, several players, including some well-funded ones, folded early. The market is now broadly dominated by Blinkit (Zomato), Zepto and Instamart (Swiggy).

It is notable that unlike competitors such as Blinkit, which is backed by Zomato, and Instamart (Swiggy), Zepto is the only major quick commerce player funded purely by investors having no background of running an operationally intensive B2C business, unlike its competitors.

Additionally, Tata-owned e-grocer BigBasket has shifted its focus to quick commerce, making 10-minute delivery the default option on its platform. The company has merged its Super Saver (slotted delivery) and BB Now (quick commerce) services into a single interface, offering customers a seamless shopping experience.

Comparison of Key Metrics of Quick Commerce Companies in India

This section provides a comparative analysis of key metrics for the leading Quick Commerce companies in India.

Monthly Transacting Users (MTUs):

According to the latest data for Q2 FY 2024-25, Blinkit leads with 8.9 million MTUs, followed by Instamart at 6.2 million. Zepto, as of December 2023, has 4.04 million MTUs.

Average Order Value (AOV):

For Q2 FY 2024-25, Blinkit has the highest AOV at ₹660, with Instamart at ₹499. Zepto's AOV, as of February 2024, stands at ₹450, with the company targeting ₹550 by January 2025.

Dark Stores:

Blinkit also leads in dark stores, with 791, followed by Instamart at 609. Zepto, as of December 2024, has 500 dark stores, with plans to increase this number to over 1,046 by March 2025.

-Iig73rh0K5OnxDXyH0epcmWergbP3a.png)

Quick Commerce Industry Outlook

The quick commerce industry is poised for significant growth, driven by the increasing demand for fast and convenient delivery services, especially in urban areas. With consumers increasingly seeking on-demand delivery of groceries, daily essentials, and other products within a short timeframe, quick commerce businesses are expanding their operations through localized dark stores to improve delivery efficiency.

The sector benefits from the rising adoption of mobile shopping and advances in logistics, allowing companies to meet the growing expectations of consumers for faster delivery, often within 10-15 minutes. As competition intensifies, players like Zepto, Swiggy Instamart, and Blinkit are continuously innovating with strategies to increase average order value (AOV), enhance customer experience, and expand dark store networks.

However, profitability remains a challenge for many, as companies strive to balance rapid growth with operational costs. Despite these challenges, the industry's future is promising, with substantial investments fueling technological advancements and improved cost-efficiency in supply chains, making quick commerce a key segment of the evolving retail landscape.